It’s no surprise that couples argue about money — a lot. You’ve had a long day at work, the house is a mess, and the kids are throwing things at each other. Then your spouse walks through the door with that thing the kids have been wanting — and it has a $100 price tag. You ask why he didn’t talk to you about the purchase first and so the fight begins.

Sound familiar?

A couple can have great intimacy, excellent teamwork, and A-plus parenting skills, but when it comes to finances, a small disagreement can send that relationship off the rails. The good news is money fights don’t have to be the norm. You and your spouse can learn to communicate about finances and grow closer together in the process.

The Facts

In late 2017, the Ramsey Research Team conducted a study of more than 1,000 adults to find out how married couples communicate and relate when it comes to money, and the results showed that money problems are causing big conflicts in marriages. In fact, money is the top reason couples fight. And money fights are the second leading cause of divorce, behind infidelity. High levels of debt and lack of communication are both major causes of the stress and anxiety surrounding household finances.

So how do you work together instead of against each other? How do you change the tone of the conversation?

Here are some suggestions to get you and your spouse on the same page:

1. Share your money stories.

You and your spouse might come from different backgrounds that shape how you feel about money. For example, my parents filed bankruptcy the year I was born, so debt was a four-letter word at our house. My husband’s family saw finances differently.

Those histories shaped how we felt about money as we grew up. If you take the time to learn your spouse’s story, you will avoid a lot of misunderstanding and conflict because you’ll understand the other person’s perspective.

2. Talk about money (even when it’s hard).

I know, talking about money can be uncomfortable, but you can’t have a healthy marriage without these conversations. So, sit down together and ask: Where do we want to be financially in the next month? Next year? Over the next five years? Talk about your fears, your dreams, and even your strengths and weaknesses when it comes to spending and saving money.

Schedule a date night or put the kids to bed early. Grab some snacks and sit down on the couch together. You’ll be amazed at how much closer you’ll feel when you start talking openly about your budget and finances.

3. Embrace your differences.

In most marriages, one person is the spender and one is the saver. In general, the spender isn’t crazy about details or plans for monthly spending (a budget). And the saver is the one who loves to run the numbers and create lists of goals and priorities. The spender helps the saver lighten up every now and then. And the planner helps the spender learn to focus on long-term money goals.

I know, talking about money can be uncomfortable, but you can’t have a healthy marriage without these conversations. So, sit down together and ask: Where do we want to be financially in the next month? Next year? Over the next five years?

Rachel Cruze

4. Recognize the roles you both play in your marriage.

God created you both uniquely and you both bring something important to the table. The key is allowing the other person to live in his or her strengths. Trying to change your spouse will only make you both miserable.

5. Make a budget — together.

The budget gets a bad rap, but it shouldn’t. It’s actually a helpful tool you can use to tell your money where to go each month — instead of wondering where it all went. A budget doesn’t have to be complicated. All you need to do is sit down with your spouse before the month begins and decide how you’ll spend your money that month. Your income minus your expenses should equal zero. Give every dollar a job to do. It will take a few months to get used to creating (and sticking to) a budget. You’ll need to make adjustments along the way — and that’s OK. Just keep at it.

6. Get rid of debt.

The first step toward improving your money situation in the long run is getting out of debt. Can you imagine what it would be like to be debt-free? It’s hard to look forward to a future together when half of your salary is going toward car payments, student loans, and credit cards every month.

To get out of debt, you need to make a plan — and that plan is called the debt snowball. Here’s how it works: List your debts smallest to largest, regardless of the interest rates. Attack the smallest debt, putting all your extra money toward paying it off while making minimum payments on everything else. Once the smallest debt is paid off, put everything you were paying on the first debt toward the next smallest debt. Keep going until you’re completely debt-free, except your mortgage. Then you can start working on your other money goals.

Just like any other skill, communicating well with your spouse takes practice. You won’t get it right every time, but that’s not the point. The goal is unity in your marriage. Learning how to handle money together is a huge part of that ongoing pursuit.

This article is adapted from HomeLife Magazine.

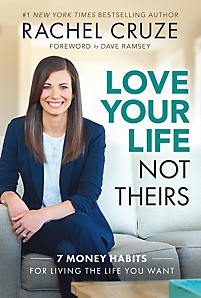

In Love Your Life, Not Theirs, Rachel Cruze shines a spotlight on the most damaging money habit we have: comparing ourselves to others. Then she unpacks seven essential money habits for living the life we really want—a life in line with our values, where we can afford the things we want to buy without being buried under debt, stress, and worry.